By American April 3, 2025

In today’s digital age, the way we make payments has evolved significantly. One of the most common methods of payment is through card transactions, which can be categorized into two types: card-present and card-not-present transactions.

In this article, we will focus on card-present transactions and explore their basics, benefits, risks, and how they work. We will also delve into the key components, security measures, common challenges, and best practices associated with card-present transactions. By the end of this comprehensive guide, you will have a thorough understanding of card-present transactions and be equipped with the knowledge to navigate this payment method effectively.

Understanding the Basics of Card-Present Transactions

Card-present transactions refer to payments made using a physical payment card, such as a credit or debit card, where the cardholder is physically present at the point of sale (POS) or payment terminal. These transactions typically occur in brick-and-mortar establishments, such as retail stores, restaurants, and hotels. The cardholder presents their card to the merchant, who then swipes, inserts, or taps the card into a card reader or terminal to initiate the transaction.

The primary purpose of card-present transactions is to facilitate convenient and secure payments for both the customer and the merchant. By using a physical card, the customer can easily make purchases without the need for cash. For merchants, accepting card payments opens up opportunities to attract more customers and increase sales. Additionally, card-present transactions offer certain advantages over card-not-present transactions, such as reduced fraud risk and lower processing fees.

Benefits and Risks of Card-Present Transactions

Card-present transactions offer several benefits for both customers and merchants. For customers, the convenience of not having to carry cash is a significant advantage. They can make purchases without worrying about having the exact amount of money or dealing with loose change. Furthermore, card-present transactions provide customers with a sense of security, as they can easily dispute any unauthorized charges or fraudulent activities on their cards.

Merchants also reap numerous benefits from accepting card-present transactions. Firstly, it expands their customer base, as many individuals prefer to pay with cards rather than cash. By accepting card payments, merchants can attract a wider range of customers, including those who do not carry cash or prefer the convenience of card transactions. Additionally, card-present transactions offer faster and more efficient payment processing, reducing the time spent on handling cash and making change.

However, card-present transactions also come with certain risks. One of the primary risks is the potential for card fraud. Criminals may attempt to use stolen or counterfeit cards to make unauthorized purchases. Merchants must be vigilant in verifying the authenticity of the card and the identity of the cardholder to mitigate this risk. Another risk is the possibility of chargebacks, where customers dispute a transaction and request a refund from their card issuer. Chargebacks can be costly for merchants, as they may lose both the sale amount and incur chargeback fees.

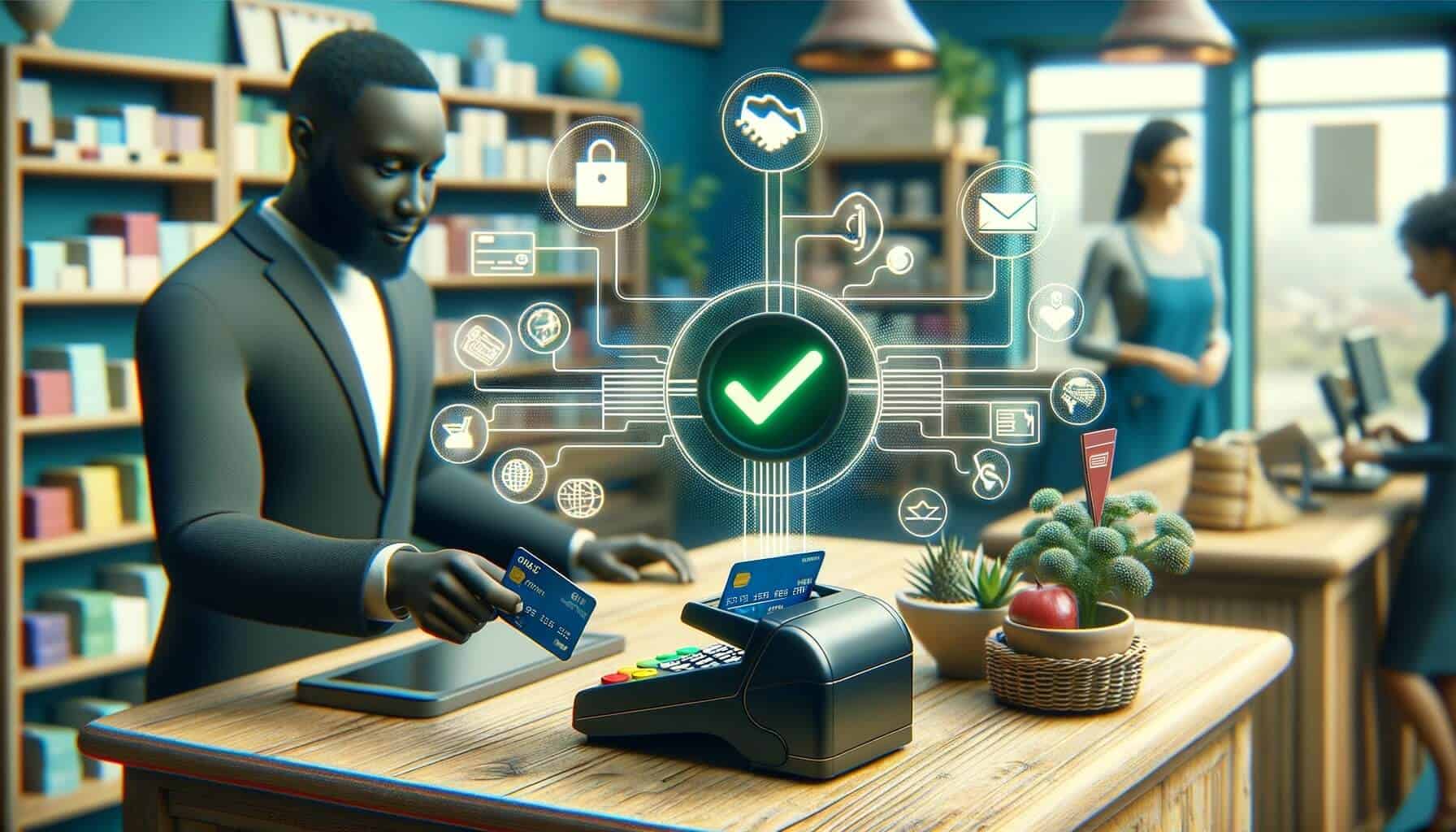

How Card-Present Transactions Work: A Step-by-Step Guide

To understand how card-present transactions work, let’s walk through the process step-by-step:

Step 1: Card Presentation – The customer presents their physical payment card to the merchant at the point of sale. This can be a credit card, debit card, or any other type of payment card.

Step 2: Card Verification – The merchant verifies the card’s authenticity by checking for security features, such as holograms, logos, and embossed numbers. They may also request additional identification, such as a driver’s license, to ensure the cardholder’s identity matches the card.

Step 3: Transaction Initiation – Once the card is verified, the merchant initiates the transaction by swiping, inserting, or tapping the card into a card reader or terminal. The card reader reads the card’s information, including the card number, expiration date, and cardholder’s name.

Step 4: Authorization Request – The card reader sends an authorization request to the card issuer or the acquiring bank. This request includes the transaction details, such as the purchase amount and merchant information.

Step 5: Authorization Response – The card issuer or acquiring bank receives the authorization request and performs a series of checks to determine whether the transaction can be approved. These checks include verifying the card’s validity, available funds, and any risk factors associated with the transaction.

Step 6: Transaction Approval or Decline – Based on the authorization response, the card issuer or acquiring bank approves or declines the transaction. If approved, the card reader displays a confirmation message, and the customer may be prompted to provide a signature or enter a PIN.

Step 7: Transaction Completion – Once the transaction is approved, the card reader completes the transaction by printing a receipt for the customer. The customer may also receive a copy of the receipt via email or SMS.

Key Components of Card-Present Transactions

Several key components play a crucial role in facilitating card-present transactions. Understanding these components is essential for both merchants and customers to ensure smooth and secure payment processing. Let’s explore these components in detail:

1. Payment Card – The payment card itself is a vital component of card-present transactions. It can be a credit card, debit card, or any other type of payment card issued by a financial institution. The card contains essential information, such as the cardholder’s name, card number, expiration date, and security features.

2. Card Reader or Terminal – The card reader or terminal is the device used by merchants to read the payment card’s information and initiate the transaction. It can be a standalone device or integrated into a point-of-sale (POS) system. The card reader communicates with the card issuer or acquiring bank to authorize and process the transaction.

3. Card Issuer – The card issuer is the financial institution that issues the payment card to the cardholder. This can be a bank, credit union, or other financial institution. The card issuer is responsible for verifying the card’s validity, managing the cardholder’s account, and authorizing transactions.

4. Acquiring Bank – The acquiring bank, also known as the merchant bank, is the financial institution that establishes and maintains the merchant’s account to accept card payments. The acquiring bank processes the transaction on behalf of the merchant and transfers the funds to their account.

5. Payment Gateway – The payment gateway is a secure service that connects the merchant’s card reader or terminal to the acquiring bank. It encrypts the transaction data and securely transmits it for authorization. The payment gateway plays a crucial role in ensuring the security and integrity of card-present transactions.

Ensuring Security in Card-Present Transactions

Security is of utmost importance in card-present transactions to protect both customers and merchants from fraud and unauthorized activities. Several measures are in place to ensure the security of these transactions. Let’s explore some of the key security practices:

1. EMV Chip Technology – EMV (Europay, Mastercard, and Visa) chip technology is a global standard for secure card-present transactions. It replaces the traditional magnetic stripe on payment cards with an embedded microchip. The chip generates a unique transaction code for each transaction, making it difficult for fraudsters to clone or counterfeit the card.

2. Point-to-Point Encryption (P2PE) – Point-to-point encryption is a security measure that encrypts the cardholder’s data from the moment it is entered into the card reader or terminal until it reaches the acquiring bank. P2PE ensures that sensitive information, such as the card number and PIN, is protected from interception or unauthorized access.

3. Tokenization – Tokenization is a process that replaces the cardholder’s sensitive data, such as the card number, with a unique identifier called a token. The token is used for transaction processing, while the actual card data is securely stored by the payment gateway or card issuer. Tokenization adds an extra layer of security by preventing the exposure of sensitive card information in case of a data breach.

4. PCI DSS Compliance – The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards established by the major card networks to protect cardholder data. Merchants accepting card-present transactions must comply with PCI DSS requirements, which include implementing secure network infrastructure, regularly monitoring and testing systems, and maintaining strict access controls.

Common Challenges and Solutions in Card-Present Transactions

While card-present transactions offer numerous benefits, they also come with their fair share of challenges. Let’s explore some common challenges faced by merchants and customers in card-present transactions and the solutions to overcome them:

1. Card Fraud – One of the most significant challenges in card-present transactions is the risk of card fraud. Fraudsters may attempt to use stolen or counterfeit cards to make unauthorized purchases. To mitigate this risk, merchants should implement robust card verification processes, such as checking for security features, requesting additional identification, and using EMV chip technology.

2. Chargebacks – Chargebacks occur when customers dispute a transaction and request a refund from their card issuer. Chargebacks can be costly for merchants, as they may lose both the sale amount and incur chargeback fees. To minimize chargebacks, merchants should maintain clear and transparent refund policies, provide excellent customer service, and keep detailed records of transactions and customer interactions.

3. Technical Issues – Technical issues with card readers or terminals can disrupt the payment process and cause inconvenience for both customers and merchants. To address this challenge, merchants should regularly maintain and update their payment devices, ensure a stable internet connection, and have backup systems in place in case of technical failures.

4. Compliance with Regulations – Merchants accepting card-present transactions must comply with various regulations, such as PCI DSS and local data protection laws. Compliance can be challenging, especially for small businesses with limited resources. Merchants should stay updated on the latest regulations, seek professional guidance if needed, and implement security measures to protect cardholder data.

Best Practices for Merchants in Card-Present Transactions

To ensure smooth and secure card-present transactions, merchants should follow best practices. These practices help minimize risks, enhance customer experience, and build trust. Let’s explore some of the best practices for merchants:

1. Implement Robust Card Verification Processes – Merchants should establish stringent card verification processes to authenticate the card’s validity and the cardholder’s identity. This can include checking for security features, requesting additional identification, and using EMV chip technology.

2. Train Staff on Security and Fraud Prevention – Properly trained staff can play a crucial role in preventing fraud and ensuring the security of card-present transactions. Merchants should provide comprehensive training to their staff on security measures, fraud prevention techniques, and how to handle suspicious transactions.

3. Regularly Update and Maintain Payment Devices – Merchants should regularly update and maintain their payment devices, including card readers or terminals. This ensures that the devices are functioning properly, have the latest security patches, and are compatible with the latest payment technologies.

4. Secure Network Infrastructure – Merchants should implement secure network infrastructure to protect cardholder data. This includes using firewalls, encryption, and secure Wi-Fi networks. Regularly monitoring and testing systems can help identify and address any vulnerabilities.

5. Educate Customers on Security Measures – Merchants should educate their customers on security measures and best practices to protect their card information. This can include providing information on how to identify phishing scams, the importance of regularly monitoring card statements, and how to report any suspicious activities.

Frequently Asked Questions about Card-Present Transactions

Q1. What is the difference between card-present and card-not-present transactions?

A1. Card-present transactions occur when the cardholder is physically present at the point of sale and uses a physical payment card. Card-not-present transactions, on the other hand, occur when the cardholder makes a payment without physically presenting the card, such as online or over the phone.

Q2. Are card-present transactions more secure than card-not-present transactions?

A2. Card-present transactions are generally considered more secure than card-not-present transactions. This is because the physical presence of the card allows for additional verification measures, such as checking for security features and requesting identification. However, both types of transactions have their own security measures and risks.

Q3. What should I do if my card is lost or stolen?

A3. If your card is lost or stolen, you should immediately contact your card issuer to report the incident. They will block your card to prevent unauthorized use and issue a replacement card. It is also advisable to monitor your card statements for any unauthorized transactions and report them promptly.

Q4. Can I dispute a transaction made through a card-present transaction?

A4. Yes, you can dispute a transaction made through a card-present transaction if you believe it is unauthorized or fraudulent. Contact your card issuer and provide them with the details of the transaction. They will investigate the dispute and may issue a refund if the transaction is found to be unauthorized.

Q5. Can merchants charge extra fees for card-present transactions?

A5. Merchants are generally not allowed to charge extra fees for card-present transactions. However, they may offer cash discounts, where customers pay a lower price if they pay with cash instead of a card. Merchants should comply with local regulations and card network rules regarding surcharges and discounts.

Conclusion

Card-present transactions play a significant role in today’s payment landscape, offering convenience, security, and efficiency for both customers and merchants. By understanding the basics, benefits, risks, and key components of card-present transactions, merchants can effectively navigate this payment method and provide a seamless experience for their customers.

Implementing security measures, following best practices, and staying updated on the latest regulations are essential for ensuring the smooth and secure processing of card-present transactions. With the right knowledge and practices, merchants can leverage card-present transactions to enhance their business and build trust with their customers.