By American February 4, 2025

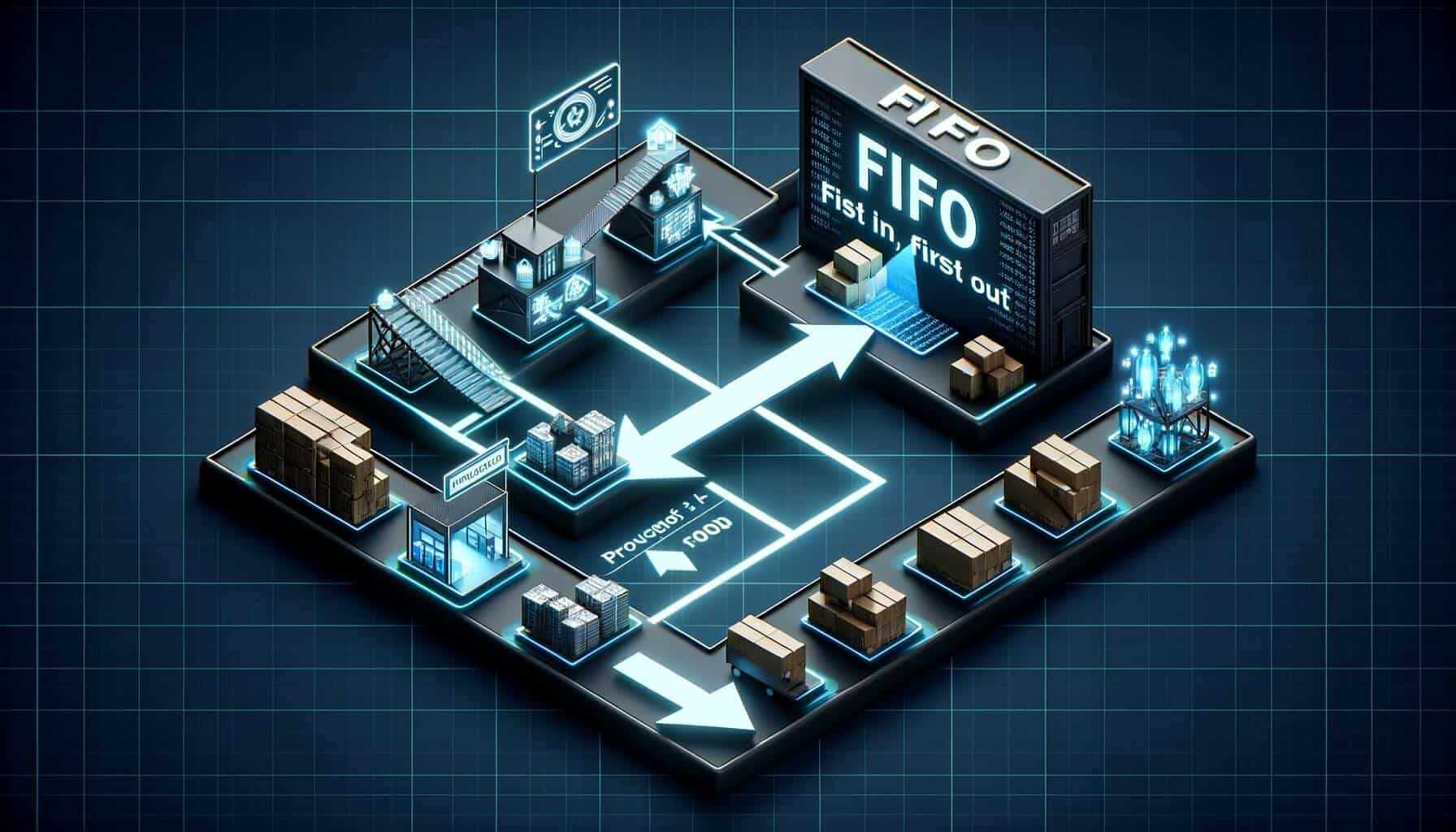

In the world of accounting, there are various methods used to value inventory and calculate the cost of goods sold (COGS). One such method is FIFO, which stands for First-In, First-Out. FIFO is a widely used inventory valuation method that assumes that the first items purchased or produced are the first ones sold.

This article will provide a comprehensive guide to understanding FIFO in accounting, including its basics, advantages, limitations, implementation, comparison with other methods, and its impact on financial statements.

Understanding the Basics of First In, First Out Method

The First In, First Out method follows a logical approach to inventory valuation. It assumes that the first items purchased or produced are the first ones sold. This means that the cost of the oldest inventory is matched with the revenue generated from the sale of goods. As a result, the remaining inventory on hand is valued at the most recent cost.

To illustrate this, let’s consider an example. Suppose a company purchases 100 units of a product at $10 each on January 1st and another 100 units at $12 each on February 1st. If the company sells 150 units in February, according to the First In, First Out method, it would assume that the first 100 units sold were from the January 1st purchase, valued at $10 each, and the remaining 50 units were from the February 1st purchase, valued at $12 each.

Advantages of Using FIFO in Accounting

There are several advantages to using the FIFO in accounting. Firstly, First In, First Out generally results in a more accurate representation of the current value of inventory. By valuing the remaining inventory at the most recent cost, FIFO provides a more realistic picture of the company’s assets.

Secondly, First In, First Out is often preferred in industries where the cost of inventory tends to rise over time. This is because FIFO assumes that the oldest and potentially lower-cost inventory is sold first, resulting in a higher valuation of the remaining inventory. This can be particularly beneficial for companies that want to show higher profits or lower tax liabilities.

Furthermore, First In, First Out is relatively easy to understand and implement. It does not require complex calculations or assumptions, making it a straightforward method for small businesses or those with limited accounting resources.

Limitations and Challenges of First In, First Out Method

While First In, First Out has its advantages, it also has some limitations and challenges. One of the main limitations is that FIFO may not accurately reflect the actual flow of goods in certain industries. For example, in industries where perishable goods or products with short shelf lives are sold, the assumption that the oldest inventory is sold first may not hold true. In such cases, using First In, First Out may result in an overvaluation of inventory and an understatement of COGS.

Another challenge of using First In, First Out is that it can lead to higher tax liabilities in periods of rising prices. As FIFO values the remaining inventory at the most recent cost, it may result in higher profits and, consequently, higher taxes. This can be a disadvantage for companies operating in industries with volatile or increasing prices.

Additionally, First In, First Out can be more complex to implement in situations where there are frequent inventory purchases or when there are significant price fluctuations. Keeping track of the cost of each individual item and ensuring accurate calculations can be time-consuming and require sophisticated accounting systems.

How to Implement FIFO in Accounting Systems

Implementing FIFO in accounting systems requires careful record-keeping and adherence to certain principles. Here is a step-by-step guide on how to implement First In, First Out:

1. Maintain detailed records: Keep track of the date, quantity, and cost of each inventory purchase. This information will be crucial for accurately applying the FIFO method.

2. Identify the oldest inventory: When a sale occurs, identify the oldest inventory available for sale. This can be done by referring to the purchase records and determining which items were acquired first.

3. Calculate the cost of goods sold: Multiply the quantity of the oldest inventory sold by its respective cost. This will give you the cost of goods sold for that particular sale.

4. Update the remaining inventory: Subtract the quantity of the oldest inventory sold from the total quantity on hand. The remaining inventory will be valued at the most recent cost.

5. Repeat the process: Continue applying the FIFO method for each subsequent sale, always using the oldest inventory available.

FIFO vs. LIFO: A Comparison of Inventory Valuation Methods

FIFO and LIFO (Last-In, First-Out) are two commonly used inventory valuation methods. While First In, First Out assumes that the first items purchased or produced are the first ones sold, LIFO assumes that the last items purchased or produced are the first ones sold. Let’s compare the two methods:

1. Valuation of inventory: FIFO values the remaining inventory at the most recent cost, while LIFO values it at the oldest cost. This means that First In, First Out generally results in a higher valuation of inventory, especially in periods of rising prices.

2. Cost of goods sold: FIFO tends to result in a lower cost of goods sold compared to LIFO when prices are rising. This is because First In, First Out matches the oldest and potentially lower-cost inventory with revenue, while LIFO matches the most recent and potentially higher-cost inventory.

3. Tax implications: FIFO can lead to higher tax liabilities in periods of rising prices, as it may result in higher profits. On the other hand, LIFO can result in lower tax liabilities, as it matches higher-cost inventory with revenue, potentially reducing profits.

4. Financial statements: FIFO generally provides a more accurate representation of the current value of inventory on the balance sheet. However, LIFO may better reflect the economic reality of certain industries, such as those with perishable goods or industries experiencing inflation.

First In, First Out (FIFO) and Cost of Goods Sold (COGS) Calculation

The cost of goods sold (COGS) is a crucial component of a company’s income statement, representing the direct costs associated with producing or acquiring the goods sold during a specific period. First In, First Out plays a significant role in calculating the COGS accurately.

To calculate the COGS using the FIFO method, follow these steps:

1. Determine the quantity of goods sold: Identify the quantity of goods sold during the period under consideration. This can be obtained from sales records or other relevant sources.

2. Identify the oldest inventory: Determine the oldest inventory available for sale based on the purchase records. This will be the inventory that is matched with the revenue generated from the sale.

3. Calculate the cost of goods sold: Multiply the quantity of the oldest inventory sold by its respective cost. This will give you the cost of goods sold for that particular sale.

4. Repeat the process: Continue applying the FIFO method for each subsequent sale, always using the oldest inventory available.

By following these steps, a company can accurately calculate the cost of goods sold using the First In, First Out method, providing a clear picture of the direct costs associated with the goods sold during a specific period.

First In, First Out (FIFO) and Financial Statements: Impact and Implications

The FIFO method has a significant impact on a company’s financial statements, particularly the balance sheet and income statement. Let’s explore the implications of First In, First Out on these financial statements:

1. Balance sheet: FIFO affects the valuation of inventory on the balance sheet. As First In, First Out values the remaining inventory at the most recent cost, it generally results in a higher valuation of inventory compared to other methods. This can lead to a higher total assets value on the balance sheet.

2. Income statement: FIFO affects the calculation of the cost of goods sold (COGS) on the income statement. By matching the oldest inventory with revenue, First In, First Out tends to result in a lower COGS compared to other methods, especially in periods of rising prices. This can lead to higher gross profit and net income figures, potentially improving the company’s financial performance.

3. Tax implications: FIFO can have tax implications, particularly in periods of rising prices. As First In, First Out may result in higher profits due to lower COGS, it can lead to higher tax liabilities. This is because taxes are typically calculated based on the company’s net income.

It is important for companies to understand the impact of First In, First Out on their financial statements and consider the potential implications when making decisions related to inventory valuation and tax planning.

Common Misconceptions and FAQs about FIFO in Accounting

Q1. Is FIFO the only inventory valuation method?

No, First In, First Out is one of several inventory valuation methods. Other commonly used methods include LIFO (Last-In, First-Out), weighted average cost, and specific identification.

Q2. Can FIFO be used for all types of inventory?

FIFO can be used for most types of inventory, but it may not be suitable for industries with perishable goods or those experiencing significant price fluctuations.

Q3. Does FIFO always result in a higher valuation of inventory?

FIFO generally results in a higher valuation of inventory compared to other methods, especially in periods of rising prices. However, this may not always be the case, as it depends on the specific circumstances and the cost of inventory.

Q4. Can FIFO be used for both perpetual and periodic inventory systems?

Yes, First In, First Out can be used for both perpetual and periodic inventory systems. However, perpetual systems provide real-time tracking of inventory, making it easier to apply the FIFO method accurately.

Q5. Can FIFO be used for financial reporting purposes?

Yes, First In, First Out can be used for financial reporting purposes. It is a widely accepted method of inventory valuation and is commonly used in financial statements.

Conclusion

In conclusion, FIFO is a widely used inventory valuation method in accounting. It assumes that the first items purchased or produced are the first ones sold, resulting in the remaining inventory being valued at the most recent cost. First In, First Out has several advantages, including providing a more accurate representation of the current value of inventory and being relatively easy to understand and implement.

However, it also has limitations and challenges, such as not accurately reflecting the actual flow of goods in certain industries and potentially leading to higher tax liabilities in periods of rising prices.

Implementing First In, First Out requires careful record-keeping and adherence to certain principles. It is important for companies to understand the impact of FIFO on their financial statements and consider the potential implications when making decisions related to inventory valuation and tax planning.