In today's digital age, businesses rely heavily on merchant services to facilitate their financial transactions. These services, provided by banks and payment processors, play a crucial role in ensuring smooth and secure payment processing for businesses of all sizes. However, there are instances where businesses and individuals encounter issues and...

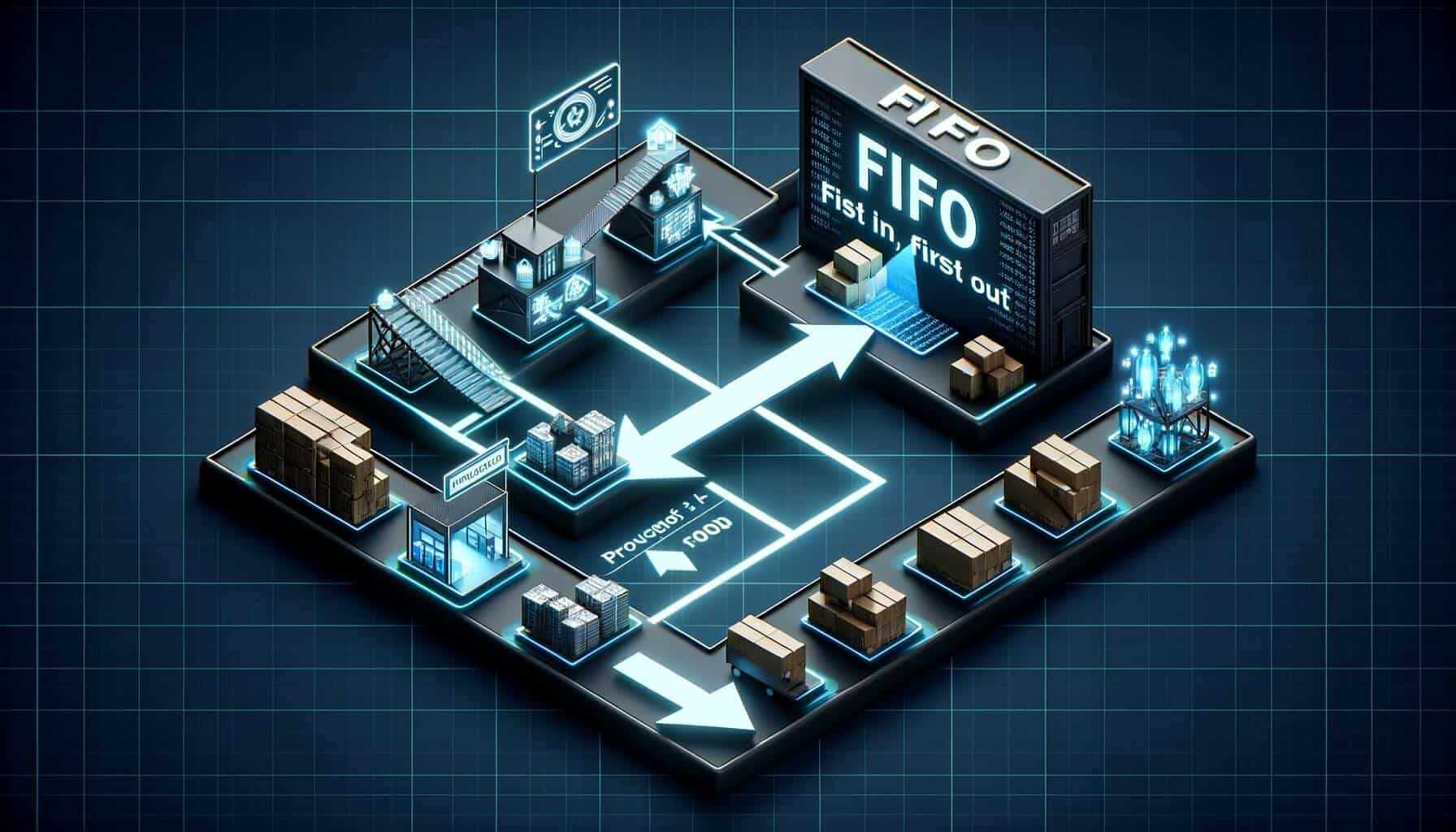

What Is FIFO in Accounting?

In the world of accounting, there are various methods used to value inventory and calculate the cost of goods sold (COGS). One such method is FIFO, which stands for First-In, First-Out. FIFO is a widely used inventory valuation method that assumes that the first items purchased or produced are the...

Revenue Cycle Management: Comprehensive RCM Guide for Healthcare

Revenue Cycle Management (RCM) is a crucial process in the healthcare industry that involves managing the financial aspects of patient care. It encompasses all the steps from scheduling an appointment to receiving payment for services rendered. Effective RCM ensures that healthcare organizations receive timely and accurate reimbursement for their services,...

What is Open Banking? A Detailed Guide

In recent years, the financial services industry has witnessed a significant transformation with the advent of open banking. Open banking is a concept that has gained momentum globally, promising to revolutionize the way individuals and businesses manage their finances. This comprehensive guide aims to provide a detailed understanding of open...