Batch transactions play a key role in payment processing as they allow businesses to handle multiple payments in bulk. Batch transactions, instead of processing each payment immediately, collect payments to be processed at once at a future point in time. This approach is widely used in banks, stores, and payroll, simplifying and reducing...

How to Set Up a Credit Card Terminal

In today's digital age, credit card terminals have become an essential tool for businesses of all sizes. These devices allow merchants to accept credit and debit card payments, providing convenience and flexibility to customers. However, setting up a credit card terminal can be a daunting task, especially for those who...

How to Select the Best Payment Terminal for Your Business

In today's digital age, having a reliable and efficient payment terminal is crucial for any business. Whether you run a small retail store or a large restaurant chain, the payment terminal you choose can significantly impact your customers' experience and your overall business operations. With numerous options available in the...

Card-Present Fraud: What It Is & How It Works

In today's digital age, where online transactions have become the norm, it's easy to overlook the risks associated with card-present fraud. Card-present fraud refers to fraudulent activities that occur when a criminal gains unauthorized access to a physical payment card and uses it to make unauthorized purchases or withdrawals. This...

Merchant Services for High-Risk Businesses: What to Consider

In today's competitive business landscape, it is essential for companies to have the ability to accept credit card payments. However, not all businesses are created equal, and some fall into the category of high-risk. These high-risk businesses face unique challenges when it comes to accepting payments, which is where merchant...

The Complete Guide to Choosing a POS System

In today's fast-paced business environment, having an efficient and reliable Point of Sale (POS) system is crucial for the success of any retail or hospitality establishment. A point of sale system not only helps streamline operations but also provides valuable insights into sales, inventory management, and customer behavior. However, with...

The Future of Mobile Payments: Trends to Watch

Mobile payments have revolutionized the way we conduct financial transactions, providing convenience, speed, and security. Over the years, mobile payments have evolved from simple SMS-based transactions to sophisticated contactless payments, digital wallets, and even blockchain technology. As technology continues to advance, the future of mobile payments holds exciting possibilities. In...

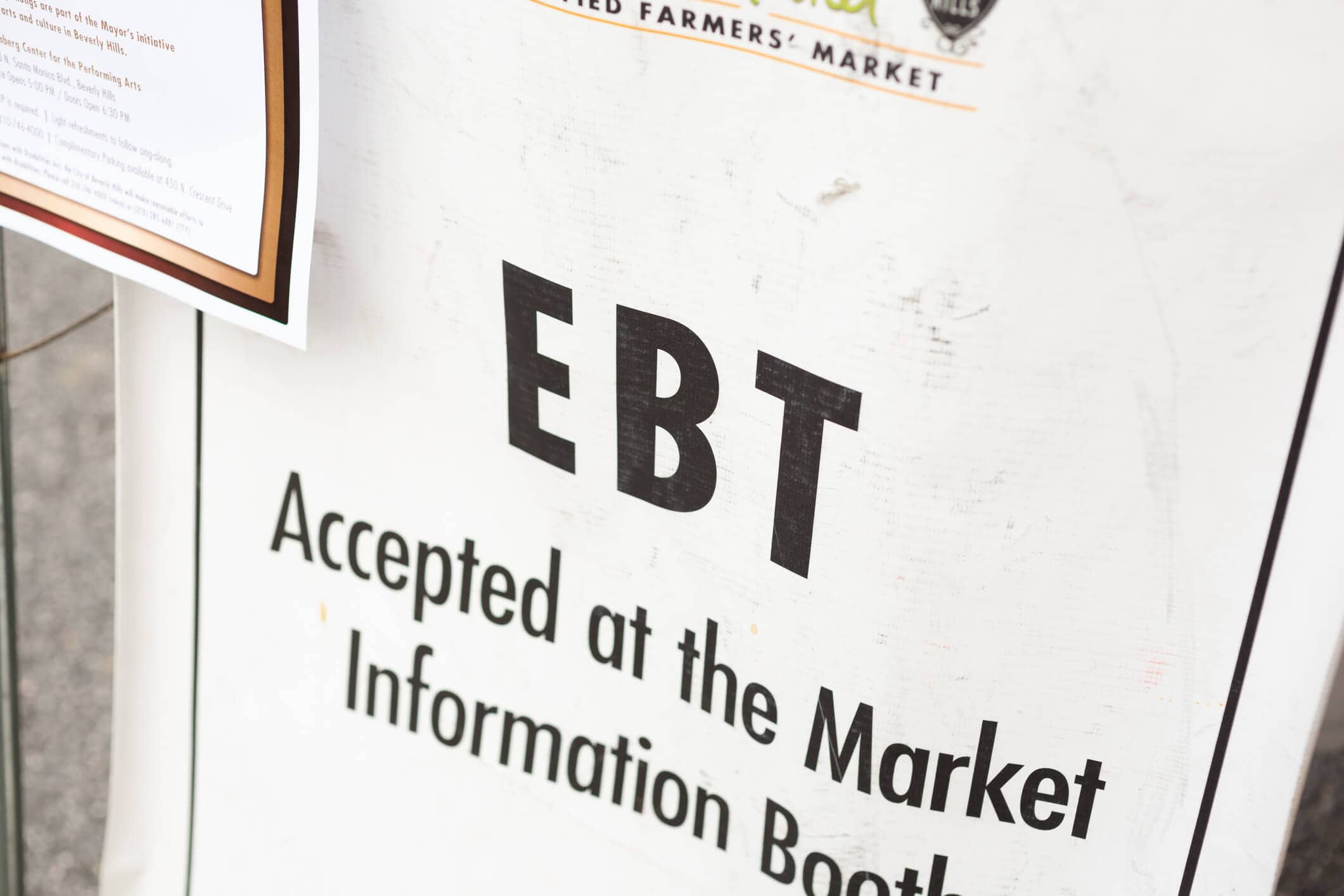

What is EBT Payment Processing? A Detailed Guide

Electronic Benefit Transfer (EBT) payment processing is a system that allows eligible individuals to receive government assistance benefits electronically. This method of payment has replaced traditional paper-based methods, such as food stamps and paper checks, making it more convenient and efficient for both merchants and customers. In this comprehensive guide,...

How Does ACH Payment Processing Work?

In today's digital age, electronic payments have become the norm for businesses and consumers alike. One popular method of electronic payment is ACH, which stands for Automated Clearing House. ACH payment processing offers a convenient and secure way to transfer funds between bank accounts. In this comprehensive article, we will...

How Payment Processing Works? A Detailed Guide

Payment processing is an essential aspect of any business that accepts electronic payments. It involves the secure transfer of funds from a customer's account to the merchant's account, ensuring a seamless and efficient transaction. In this comprehensive guide, we will delve into the intricacies of payment processing, exploring the role...

Understanding Credit Card Processing Fees: What Merchants Need to Know

In today's digital age, credit card processing has become an essential part of running a successful business. However, understanding the intricacies of credit card processing fees can be a daunting task for many merchants. In this comprehensive guide, we will delve into the world of credit card processing fees, providing...