Payment security is no longer a “once-a-year audit” problem. It’s an always-on risk management discipline—because attackers don’t wait for assessment season, and customers don’t forgive preventable data exposure. That is exactly why the PCI Data Security Standard (PCI DSS) keeps evolving: to set a baseline of technical and operational controls...

Payment Gateway Security Features: The Complete, Updated Guide to Safer Online Payments

Online commerce runs on trust. The moment a customer enters card details, logs into a wallet, or approves a bank transfer, your checkout becomes a target. That is why payment gateway security features are no longer “nice to have.” They are the difference between smooth approvals and a breach, between...

Payment Processing Integration With QuickBooks (2026 Best Guide)

Payment processing integration with QuickBooks is the fastest way to turn sales activity into clean books—without the daily scramble of downloading reports, fixing deposit mismatches, or guessing which fees belong to which payout. When your payment processor and QuickBooks are properly connected, every card sale, bank transfer, refund, chargeback, and...

Payment Technology Trends for Small Businesses

Running a small business has always meant balancing speed, cost, and trust. But in the last few years, payments have turned into a competitive advantage, not just a necessary expense. The biggest shift is that customers now expect payments to be invisible: tap, click, confirm, done. At the same time,...

Building a Long-Term Payments Strategy

A long-term payment strategy is no longer “set it and forget it.” Payment methods, fraud patterns, customer expectations, and compliance requirements change every year—and sometimes every quarter. The businesses that win are the ones that treat payments like a product: designed around customer experience, protected by layered security, measured by...

Step-by-Step: Switching Payment Providers Without Disrupting Sales

Switching payment providers is a strategic choice that can have a big impact on a company’s future; it’s not just a technical one. Payment processing is central to cash flow, customer interactions, and business continuity for many businesses. However, switching becomes essential when companies outgrow their current provider or experience...

Top Cash App Alternatives for Business and How to Pick the Best

Cash App has broken into the mainstream in peer-to-peer payments, known for its simplicity and speed. It’s a popular early-stage go-to option for countless small businesses, given the ease of setup, lack of monthly fees and simple payment tools. But for businesses that expand or need more complex features, many...

Batch Transactions Explained: What They Are and How They Work

Batch transactions play a key role in payment processing as they allow businesses to handle multiple payments in bulk. Batch transactions, instead of processing each payment immediately, collect payments to be processed at once at a future point in time. This approach is widely used in banks, stores, and payroll, simplifying and reducing...

How to Set Up a Credit Card Terminal

In today's digital age, credit card terminals have become an essential tool for businesses of all sizes. These devices allow merchants to accept credit and debit card payments, providing convenience and flexibility to customers. However, setting up a credit card terminal can be a daunting task, especially for those who...

Portable Credit Card Terminals: Everything You Need to Know

In today's fast-paced world, convenience and efficiency are key factors in running a successful business. One aspect that plays a crucial role in achieving these goals is the ability to accept credit card payments. Portable credit card terminals have revolutionized the way businesses process transactions, providing a convenient and secure...

How to Select the Best Payment Terminal for Your Business

In today's digital age, having a reliable and efficient payment terminal is crucial for any business. Whether you run a small retail store or a large restaurant chain, the payment terminal you choose can significantly impact your customers' experience and your overall business operations. With numerous options available in the...

What is a Payment Service Provider (PSP) and How Do They Work?

In today's digital age, online payments have become an integral part of our daily lives. Whether it's purchasing goods and services or transferring money to friends and family, the convenience of online payments cannot be overstated. Behind the scenes, payment service providers (PSPs) play a crucial role in facilitating these...

How to Select the Best Credit Card Machine for Your Business

In today's digital age, accepting credit card payments is essential for businesses of all sizes. Whether you run a small retail store or a large e-commerce platform, having a reliable and efficient credit card machine is crucial for smooth transactions and customer satisfaction. However, with so many options available in...

How to Find the Right Credit Card Terminal for Your Business

In today's digital age, accepting credit card payments is essential for businesses of all sizes. To facilitate these transactions, businesses need a reliable and efficient credit card terminal. However, with a wide range of options available in the market, finding the right credit card terminal can be a daunting task....

Card-Not-Present (CNP) Transactions Explained

In today's digital age, the way we make payments has evolved significantly. With the rise of e-commerce and the convenience of online shopping, card-not-present (CNP) transactions have become increasingly prevalent. CNP transactions refer to any payment made without the physical presence of the cardholder, such as online, phone, or mail...

What are Card-Present Transactions?

In today's digital age, the way we make payments has evolved significantly. One of the most common methods of payment is through card transactions, which can be categorized into two types: card-present and card-not-present transactions. In this article, we will focus on card-present transactions and explore their basics, benefits, risks,...

Credit Card Processing Outages: Why They Happen and What You Can Do

In today's digital age, credit card processing has become an integral part of conducting business transactions. However, like any technology, credit card processing systems are not immune to occasional outages. These outages can have a significant impact on businesses, causing financial losses and customer dissatisfaction. Understanding why credit card processing...

What is Recurring Payment Processing: A Complete Guide for Businesses

In today's digital age, businesses are constantly seeking ways to streamline their operations and improve customer experience. One such solution that has gained significant popularity is recurring payment processing. Recurring payment processing allows businesses to automatically collect payments from customers on a regular basis, eliminating the need for manual invoicing...

What is an EFT Payment? A Complete Guide

In today's digital age, electronic funds transfer (EFT) payments have become an integral part of our daily lives. Whether you're paying bills, making online purchases, or receiving your salary, chances are you've used EFT payments without even realizing it. But what exactly is an EFT payment, and how does it...

Secure Payment Processing Systems: A Complete Guide

In today's digital age, secure payment processing systems have become an essential component of any business that accepts online payments. With the increasing prevalence of cyber threats and data breaches, it is crucial for businesses to prioritize the security of their customers' payment information. In this comprehensive guide, we will...

Merchant Services Class Action Lawsuit

In today's digital age, businesses rely heavily on merchant services to facilitate their financial transactions. These services, provided by banks and payment processors, play a crucial role in ensuring smooth and secure payment processing for businesses of all sizes. However, there are instances where businesses and individuals encounter issues and...

How to Sell Handmade Goods Online

In today's digital age, selling handmade goods online has become a lucrative opportunity for artisans and crafters. With the rise of e-commerce platforms and the increasing demand for unique and personalized products, the online marketplace offers a vast potential customer base and the ability to reach customers from all around...

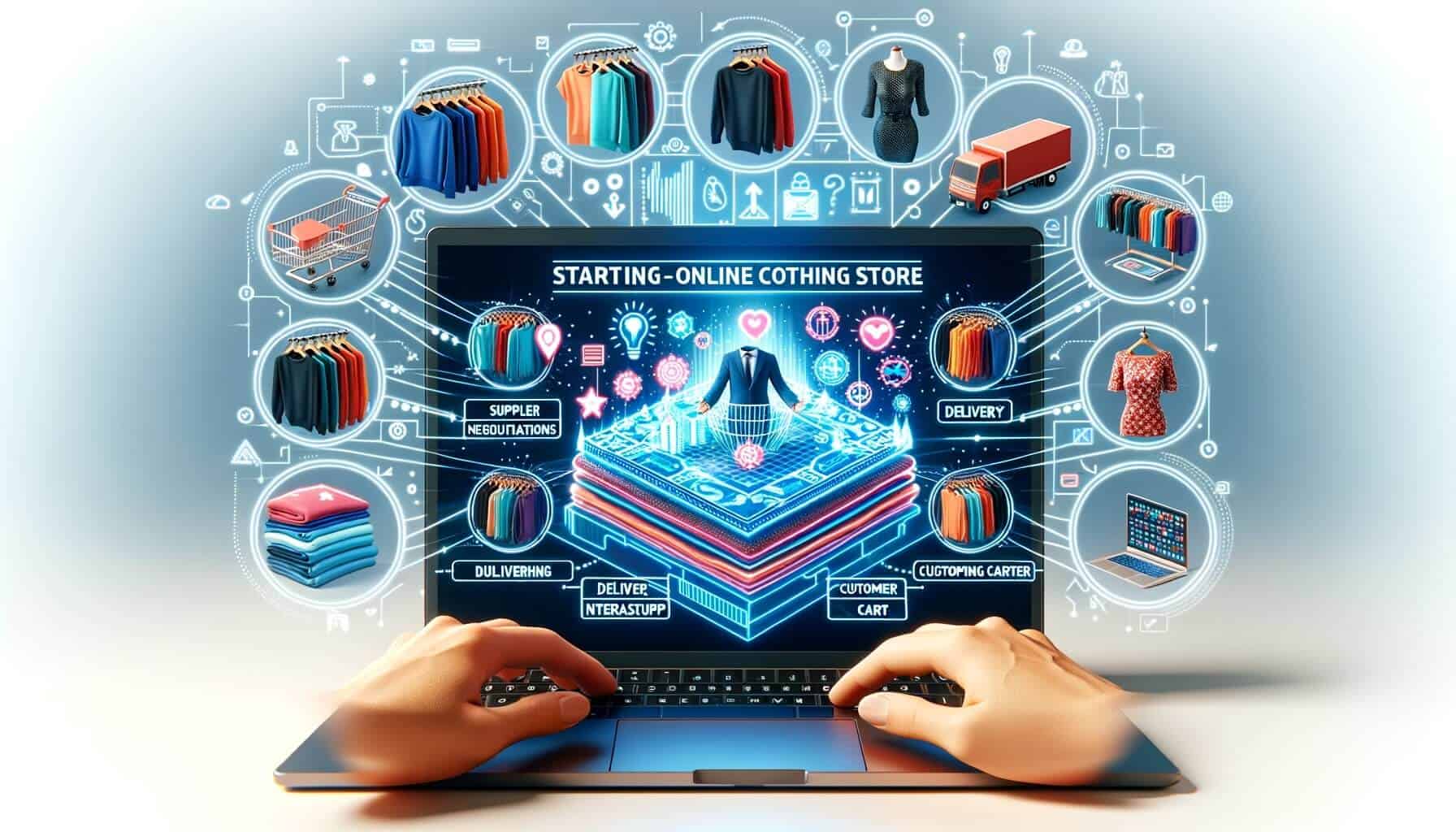

How to Start an Online Clothing Store

Starting an online clothing store can be an exciting and profitable venture. With the rise of e-commerce and the increasing popularity of online shopping, the demand for online clothing stores has never been higher. However, like any business, starting an online clothing store requires careful planning and execution. In this...

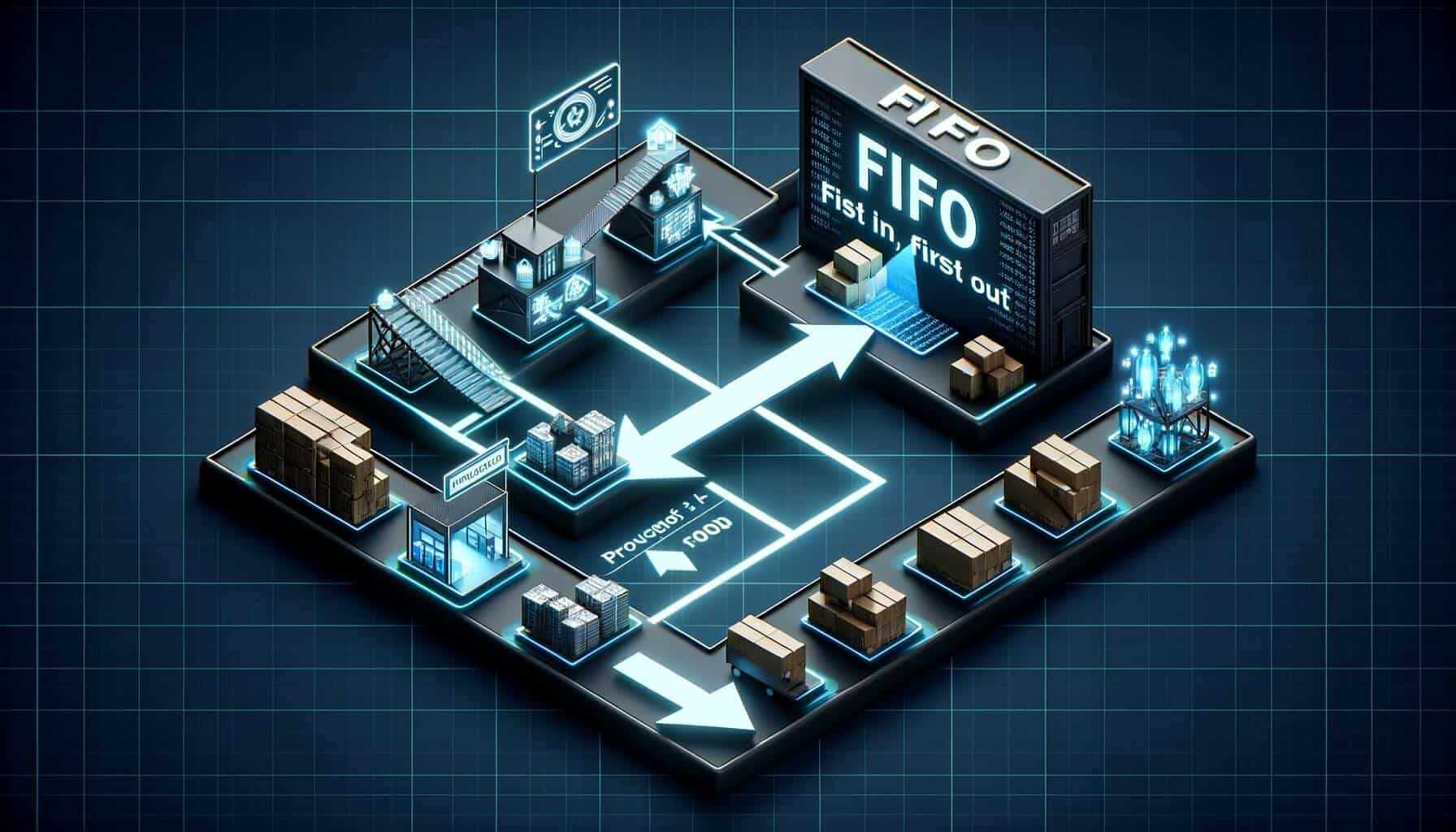

What Is FIFO in Accounting?

In the world of accounting, there are various methods used to value inventory and calculate the cost of goods sold (COGS). One such method is FIFO, which stands for First-In, First-Out. FIFO is a widely used inventory valuation method that assumes that the first items purchased or produced are the...

4 Levels of PCI Compliance: A Complete Guide

In today's digital age, where online transactions have become the norm, ensuring the security of sensitive payment card information is of utmost importance. This is where PCI compliance comes into play. PCI compliance, or Payment Card Industry compliance, refers to the set of security standards established by the Payment Card...

Velocity Checks and Fraud Prevention

In today's digital age, where online transactions have become the norm, the risk of fraud has also increased significantly. Fraudsters are constantly finding new ways to exploit vulnerabilities in payment systems and steal sensitive information. To combat this growing threat, businesses and financial institutions have turned to velocity checks as...

How Chargeback Insurance Can Benefit You As A Merchant

As a merchant, chargebacks can be a significant concern for your business. Chargebacks occur when a customer disputes a transaction and requests a refund from their bank or credit card company. These chargebacks can result in financial losses, increased fees, and damage to your reputation. However, there is a solution...

What is Chargeback Representment

Chargeback representment is a crucial process for businesses that accept credit card payments. It involves disputing chargebacks, which are initiated by customers who believe they have been wrongfully charged or have not received the goods or services they paid for. Chargeback representment allows merchants to present evidence and arguments to...

How to Dispute a Wells Fargo Chargeback

Wells Fargo is one of the largest banks in the United States, serving millions of customers with a wide range of financial services. However, even with the best intentions, mistakes can happen, and you may find yourself facing a chargeback on your Wells Fargo account. A chargeback occurs when a...

What is a Payment Reversal and How Does it Work

In today's digital age, payment reversals have become a common occurrence in the world of financial transactions. Whether you are a business owner or a consumer, understanding what they are and how they work is crucial to navigating the complex landscape of online payments. In this comprehensive guide, we will...

Revenue Cycle Management: Comprehensive RCM Guide for Healthcare

Revenue Cycle Management (RCM) is a crucial process in the healthcare industry that involves managing the financial aspects of patient care. It encompasses all the steps from scheduling an appointment to receiving payment for services rendered. Effective RCM ensures that healthcare organizations receive timely and accurate reimbursement for their services,...

Card-Not-Present Fraud: Everything you Need to Know

In today's digital age, where online shopping and electronic transactions have become the norm, the risk of fraud has also increased significantly. One of the most prevalent forms of fraud is card-not-present (CNP) fraud, which occurs when a transaction is made without the physical presence of the cardholder. This type...

Card-Present Fraud: What It Is & How It Works

In today's digital age, where online transactions have become the norm, it's easy to overlook the risks associated with card-present fraud. Card-present fraud refers to fraudulent activities that occur when a criminal gains unauthorized access to a physical payment card and uses it to make unauthorized purchases or withdrawals. This...

What is Two-Factor Authentication?

In today's digital age, the need for robust security measures has become more critical than ever. With the increasing number of cyber threats and data breaches, it is essential to protect our online accounts and sensitive information from unauthorized access. One of the most effective ways to enhance security is...

How Wireless Credit Card Processing Works

In today's fast-paced world, convenience and efficiency are key factors in the success of any business. One area where this is particularly evident is in the realm of payment processing. Gone are the days of cash-only transactions or relying solely on traditional point-of-sale systems. With the advent of wireless credit...

How to track an ACH Transaction

In today's digital age, electronic payments have become increasingly popular, and one of the most widely used methods is the Automated Clearing House (ACH) system. ACH transactions allow individuals and businesses to transfer funds electronically between bank accounts, providing a convenient and efficient alternative to traditional paper checks. However, tracking...

Flat Rate vs Interchange Plus Pricing in Payment Processing

Payment processing is an essential aspect of any business that accepts electronic payments. Whether you run an online store, a brick-and-mortar shop, or a service-based business, having a reliable and efficient payment processing system is crucial for your success. When it comes to payment processing, there are two primary pricing...

Understanding EMV Chip Card Technology

In today's digital age, the security of our financial transactions is of utmost importance. With the rise in credit card fraud and data breaches, it has become crucial for businesses and consumers to adopt more secure payment methods. One such technology that has gained widespread adoption is EMV chip card...

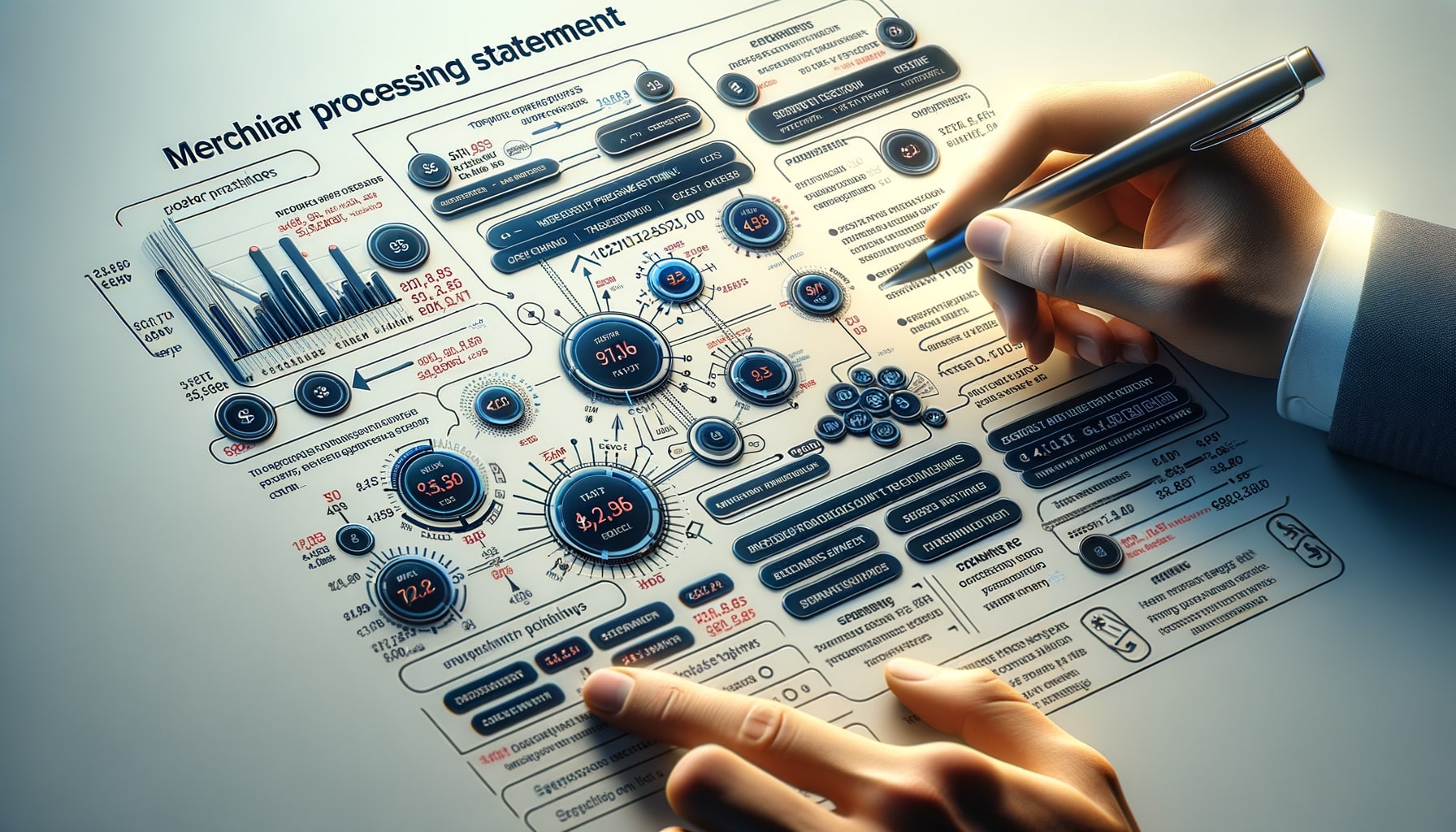

How To Read Your Merchant Processing Statement

Merchant processing statements are essential documents that provide a detailed breakdown of a business's credit card processing activity. These statements contain crucial information about sales, fees, chargebacks, and other financial transactions. Understanding how to read and analyze these statements is vital for merchants to effectively manage their payment processing operations...

What is Flat Rate Pricing?

Flat rate pricing is a pricing strategy that involves charging customers a fixed fee for a particular product or service, regardless of the actual cost or time involved in delivering it. This approach is in contrast to other pricing models, such as hourly rates or cost-plus pricing, where the price...

What is an ACH Return and How to Handle Them

In today's digital age, electronic payments have become the norm for businesses and individuals alike. One of the most popular methods of electronic payment is the Automated Clearing House (ACH) system. ACH allows for the transfer of funds between bank accounts, making it convenient and efficient for various financial transactions....

How to Find the Right MCC Code for Your Business

Finding the right Merchant Category Code (MCC) for your business is essential to ensure accurate classification, fair processing fees, compliance with industry regulations, and even optimization of tax reporting. MCC codes are used by payment processors and credit card networks to categorize businesses based on the types of goods and...

Understanding MCC Codes for Your Business Type

Merchant Category Codes (MCC) are essential identifiers in the payment processing ecosystem, as they help classify businesses based on the types of goods or services they provide. For business owners, understanding MCC codes is vital because these codes impact various aspects of their operations, from tax reporting to interchange fees....

What Factors Affect Interchange Fees?

Interchange fees are one of the most significant costs merchants face when accepting credit and debit card payments. These fees are charged by the card-issuing bank to the acquiring bank (the merchant’s bank) as compensation for processing a transaction. While interchange fees are essential for the smooth functioning of the...

How Interchange Fees Are Calculated: A Complete Guide

Interchange fees are an essential yet complex part of the payment processing ecosystem. These fees, which merchants must pay to accept credit and debit card payments, can significantly impact the profitability of businesses. Understanding how interchange fees are calculated is crucial for merchants to make informed decisions regarding their payment...

What Are Interchange Fees and Why Do They Matter?

In today's rapidly evolving financial landscape, businesses and consumers alike depend heavily on credit and debit cards for conducting transactions. Behind each transaction lies a complex system of fees that enable the seamless processing of payments. One of the most significant components of this system is the interchange fee, which...

Advantages of Interchange Plus Pricing for Small Businesses

Small businesses are often searching for cost-effective and transparent solutions when it comes to credit card processing fees. One pricing model that has gained considerable popularity for its fairness and transparency is Interchange Plus pricing. This model is particularly beneficial for small businesses looking to reduce their payment processing costs...

What Is Interchange Plus Pricing: A Complete Guide

Interchange Plus pricing has become one of the most popular pricing models for businesses seeking transparency and cost-effectiveness in credit card processing. This model is widely regarded as a fairer and more transparent way for businesses to handle transaction fees, as it breaks down the costs associated with processing payments,...

How to Choose a Payment Processor for Your Online Store

Choosing the right payment processor for your online store is a critical decision that can impact your business's overall success. A payment processor is responsible for handling online transactions, ensuring that funds are transferred securely from your customers to your business. The right processor will not only provide a seamless...

Merchant Services for High-Risk Businesses: What to Consider

In today's competitive business landscape, it is essential for companies to have the ability to accept credit card payments. However, not all businesses are created equal, and some fall into the category of high-risk. These high-risk businesses face unique challenges when it comes to accepting payments, which is where merchant...