In today's digital age, the Internet of Things (IoT) has become an integral part of our daily lives. From smart homes to connected cars, IoT devices have revolutionized the way we interact with technology. One area where IoT is making a significant impact is in payment processing. With the rise...

How Blockchain Technology Enhances Payment Security

In today's digital age, payment security has become a paramount concern for individuals and businesses alike. With the rise of online transactions and the increasing sophistication of cyber threats, traditional payment systems are facing numerous vulnerabilities. However, the emergence of blockchain technology has provided a promising solution to enhance payment...

Benefits to Using Multi-Currency Payment Gateway

In today's globalized world, businesses are increasingly expanding their reach beyond borders and catering to customers from different countries. However, one of the challenges they face is accepting payments in multiple currencies. This is where a multi-currency payment gateway comes into play. A multi-currency payment gateway is a technology solution...

What is a 3D Payment Gateway? A Detailed Guide

In today's digital age, online transactions have become an integral part of our lives. Whether it's purchasing goods or services, paying bills, or transferring funds, the convenience of online payments cannot be denied. However, with the increasing number of cyber threats and fraudulent activities, ensuring the security of these transactions...

Top Features To Look For in a Payment Gateway

In today's digital age, having a reliable payment gateway is crucial for any business that operates online. A payment gateway is a technology that enables businesses to accept and process payments from customers securely and efficiently. It acts as a bridge between the customer, the merchant, and the financial institutions...

What is the NMI Payment Gateway? A Detailed Guide

In today's digital age, online payments have become an integral part of businesses across various industries. To facilitate secure and seamless transactions, payment gateways play a crucial role. One such payment gateway that has gained significant popularity is the NMI Payment Gateway. NMI, short for Network Merchants Inc., is a...

Non-Profit Payment Processing: Everything you Need to Know

Non-profit organizations play a crucial role in society by addressing various social, environmental, and humanitarian issues. These organizations heavily rely on donations and contributions from individuals and corporations to fund their operations and fulfill their missions. To effectively manage these financial transactions, non-profits need a reliable and efficient payment processing...

What is a Payment Facilitator? Everything You Need to Know

In today's digital age, the world of commerce has undergone a significant transformation. With the rise of e-commerce and online transactions, businesses of all sizes are constantly seeking efficient and secure payment solutions. This is where payment facilitators come into play. A payment facilitator, also known as a payfac or...

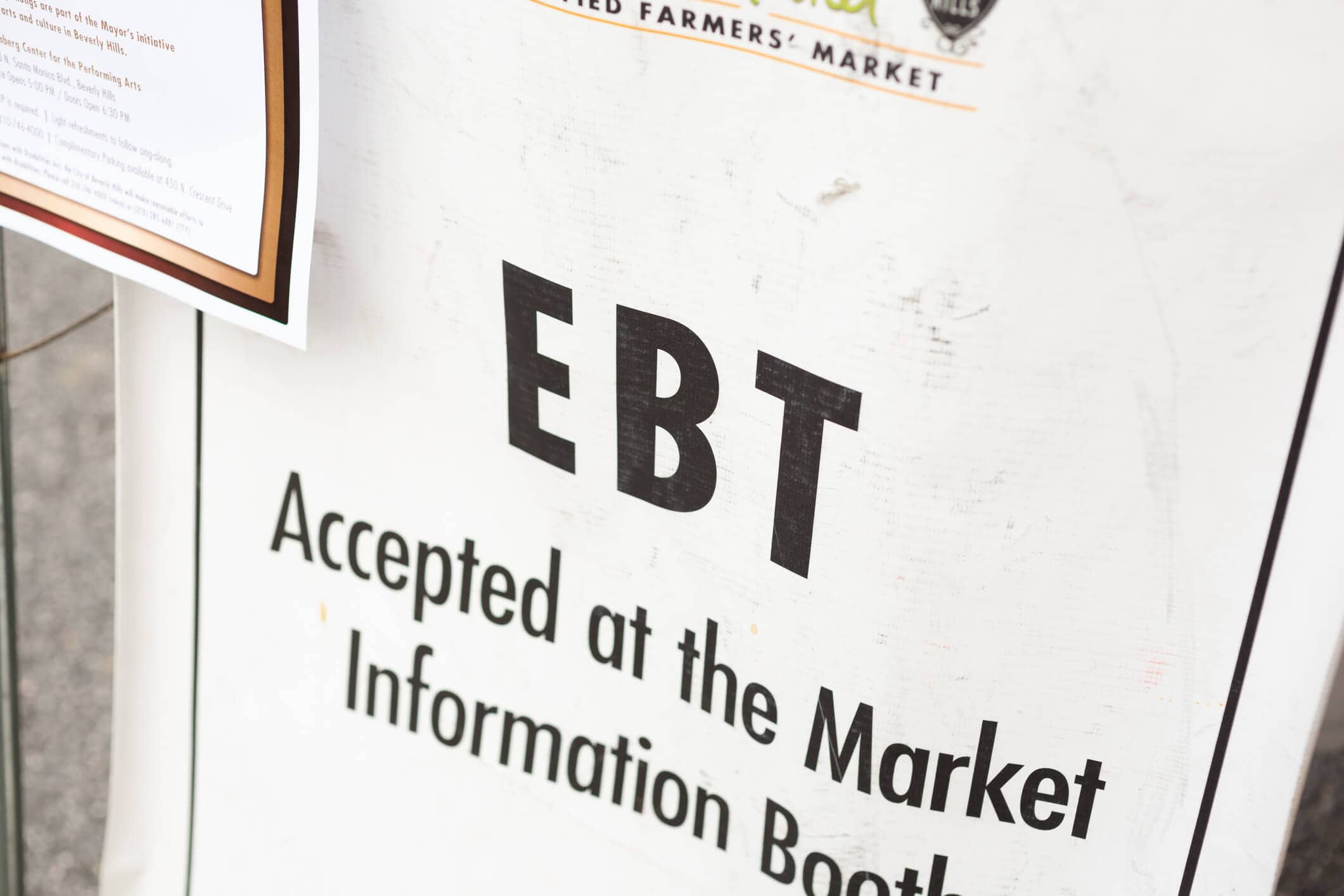

What is EBT Payment Processing? A Detailed Guide

Electronic Benefit Transfer (EBT) payment processing is a system that allows eligible individuals to receive government assistance benefits electronically. This method of payment has replaced traditional paper-based methods, such as food stamps and paper checks, making it more convenient and efficient for both merchants and customers. In this comprehensive guide,...

Payment APIs: What Are They and How Do They Work?

In today's digital age, online payments have become an integral part of our lives. Whether it's purchasing goods and services or transferring money to friends and family, the convenience of online payments cannot be overstated. Behind the scenes, payment APIs play a crucial role in facilitating these transactions seamlessly and...

The Ultimate Guide to Hotel Payment Processing

In today's fast-paced and technologically advanced world, the hospitality industry has seen significant changes in how payments are processed. For hotel owners and managers, understanding the nuances of payment processing is essential for efficient operations and enhancing the guest experience. This comprehensive guide delves into all aspects of hotel payment...

How Does ACH Payment Processing Work?

In today's digital age, electronic payments have become the norm for businesses and consumers alike. One popular method of electronic payment is ACH, which stands for Automated Clearing House. ACH payment processing offers a convenient and secure way to transfer funds between bank accounts. In this comprehensive article, we will...

How Does Mobile Payment Processing Work? A Detailed Guide

Mobile payment processing has revolutionized the way we make transactions in today's digital age. With the increasing popularity of smartphones and the convenience they offer, mobile payment processing has become an integral part of our daily lives. Whether it's paying for groceries, shopping online, or splitting a bill with friends,...

Payment Gateway vs. Payment Processor: What Is the Difference?

In today's digital age, online transactions have become an integral part of our daily lives. Whether it's purchasing goods or services, making donations, or paying bills, the convenience of online payments has revolutionized the way we conduct financial transactions. Behind the scenes, two crucial components play a significant role in...

What is a Third-Party Payment Processor? Everything you Need to Know

In today's digital age, online transactions have become an integral part of our daily lives. Whether it's purchasing goods or services, paying bills, or transferring funds, the convenience of online payments cannot be overstated. Behind the scenes, however, there is a complex network of financial institutions and technology that ensures...

How Payment Processing Works? A Detailed Guide

Payment processing is an essential aspect of any business that accepts electronic payments. It involves the secure transfer of funds from a customer's account to the merchant's account, ensuring a seamless and efficient transaction. In this comprehensive guide, we will delve into the intricacies of payment processing, exploring the role...

How to Lower Your Credit Card Processing Fees

Credit card processing fees are an essential aspect of running a business that accepts credit card payments. These fees are charged by payment processors for the services they provide, including processing transactions, managing fraud risks, and ensuring secure payment processing. As a business owner, it is crucial to understand how...

Understanding Merchant Account Fees: A Comprehensive Guide

In today's digital age, businesses of all sizes rely heavily on electronic payments to conduct transactions with their customers. To facilitate these transactions, merchants need to have a merchant account, which allows them to accept credit and debit card payments. However, having a merchant account comes with various fees and...

How to Choose the Right Merchant Services Provider

In today's digital age, businesses of all sizes rely heavily on electronic payments to conduct transactions with their customers. Whether you operate a brick-and-mortar store or an online business, having a reliable and efficient payment processing system is crucial for your success. This is where a merchant services provider comes...

What is a Merchant Agreement & How Does it Work?

A merchant agreement is a legally binding contract between a merchant and a payment processor or acquiring bank. It outlines the terms and conditions under which the merchant can accept and process payments from customers using credit or debit cards. This agreement is crucial for businesses that want to accept...

Cash Discount Programs: A Detailed Guide for Merchants

Cash discount programs have gained popularity among merchants as a way to offset the costs associated with credit card processing fees. These programs offer a unique approach to pricing, allowing businesses to offer a lower price to customers who pay with cash while maintaining their profit margins. In this comprehensive...

The Role of ISOs and MSPs in Credit Card Processing

In today's digital age, credit card processing has become an integral part of conducting business. Whether you run a small retail store or an e-commerce website, accepting credit card payments is essential to meet the demands of modern consumers. However, managing credit card transactions can be complex and time-consuming, requiring...

How to Sell Merchant Services? A Detailed Guide

Merchant services refer to the financial services that enable businesses to accept and process electronic payments from their customers. These services include credit card processing, debit card processing, online payment gateways, and other electronic payment solutions. In today's digital age, merchant services have become an essential part of running a...

Selling Cash Discount Merchant Services: A Detailed Guide

Cash discount merchant services are a popular payment processing solution that allows businesses to offset their credit card processing fees by offering a cash discount to customers who pay with cash. This innovative approach to payment processing has gained traction in recent years, as businesses look for ways to reduce...

How to Accept Credit Card Payments: Step by Step Guide

Accepting credit card payments is an essential aspect of running a successful business in today's digital age. With the rise of e-commerce and the increasing popularity of online shopping, businesses that do not accept credit card payments risk losing out on potential customers and revenue. In this comprehensive guide, we...

Payment Gateway vs Merchant Account: A Detailed Guide

Understanding the differences between a payment gateway and a merchant account is essential for businesses that operate online or accept card payments in person. This detailed guide will help clarify the roles of each and how they work together to facilitate online transactions, ensuring a seamless payment experience for customers....

How to Integrate a Payment Gateway into a Website: A Detailed Guide

In the digital age, integrating a payment gateway into a website is a crucial step for businesses looking to facilitate online transactions efficiently and securely. This guide provides a comprehensive overview of how to integrate a payment gateway into your website, suitable for various industries. We'll cover the basics, best...

Setting Up a Merchant Account for your Online Store

Setting up a merchant account for your online store is crucial for success. With the increasing popularity of online shopping, customers expect a seamless and secure payment process. It allows businesses to accept and process electronic payment methods like credit cards, which is essential in today's digital marketplace. This guide will...

What Is A Neobank? A Detailed Guide

In the ever-evolving landscape of financial services, the emergence of neobanks represents a significant shift towards digital banking solutions. This article provides a comprehensive exploration of neobanks, discussing their business models, comparisons with traditional and online banks, their advantages, potential risks, and addressing frequently asked questions. The Evolution and growth...

How to Securely Store Customer Payment Information

In today's digital age, securely storing customer payment information is of utmost importance for businesses. With the increasing prevalence of cyber threats and data breaches, it is crucial for organizations to implement robust security measures to protect sensitive customer data. This comprehensive guide will provide you with a detailed overview...

API-Hosted Payment Gateways: Everything You Need to Know

An API-Hosted Payment Gateway is a technology that allows businesses to accept online payments securely and efficiently. It acts as a bridge between the merchant's website or application and the payment processor, facilitating the transfer of payment information. Unlike traditional payment gateways, API-hosted payment gateways provide a seamless integration experience...

Hosted Payment Gateway: A Detailed Guide

A hosted payment gateway is an essential component in the e-commerce ecosystem, facilitating the secure and efficient processing of online payments. This guide provides a comprehensive overview of hosted payment gateway, covering how they function, their benefits, potential drawbacks, and frequently asked questions. By the end of this guide, you...

Understanding Payment Gateways: What Every Merchant Should Know

Payment gateways are a critical component of modern e-commerce, acting as the intermediary to facilitate all transactions between merchants, customers, and financial institutions. This article provides an in-depth understanding of what payment gateways are, how they function, and what every merchant needs to know to make informed decisions. What is...

Best Security Practices for Handling Online Transactions

In today's digital age, online transactions have become an integral part of our daily lives. From shopping online to paying bills, the convenience and ease of conducting transactions from the comfort of our homes or on-the-go cannot be denied. However, with this convenience comes the need for heightened security measures...

Exploring the Benefits of Integrated Payment Systems

In today's fast-paced digital world, businesses are constantly seeking ways to streamline their operations and improve efficiency. One area that has seen significant advancements is payment systems. Integrated payment systems have emerged as a game-changer for businesses, offering a wide range of benefits that can revolutionize the way transactions are...

How to Choose Payment Solutions for E-commerce Marketplaces

E-commerce marketplaces have become increasingly popular, offering consumers a convenient way to shop for a wide range of products and services. However, for these marketplaces to thrive, it is crucial to have a reliable and efficient payment solution in place. Payment solutions play a vital role in ensuring a seamless...

Maximizing Your POS System: Tips and Tricks

In today's fast-paced business landscape, having a reliable and efficient Point of Sale (POS) system is crucial for the success of any business. A POS system not only helps streamline operations but also plays a vital role in enhancing customer experience and boosting sales. However, to truly maximize the potential...

The Future of Payment Processing: Trends to Watch

Payment processing has come a long way since the days of bartering and exchanging goods. With the advent of technology, the way we make payments has evolved significantly, and this evolution shows no signs of slowing down. In the coming years, we can expect to see several trends that will...

Understanding PCI Compliance and Why It Matters

PCI compliance, short for Payment Card Industry Data Security Standard compliance, is a set of security standards that businesses must adhere to in order to protect cardholder data and prevent data breaches. In this comprehensive guide, we will delve into the world of PCI compliance, exploring its importance for merchants,...

Fraud Prevention Tips for Online Merchants

In today's digital age, online merchants face a constant threat of fraud. With the increasing popularity of e-commerce, fraudsters are finding new ways to exploit vulnerabilities and steal sensitive information. As an online merchant, it is crucial to understand the importance of fraud prevention and take proactive measures to safeguard...

The Impact of Mobile Payments on Small Businesses

In today's digital age, mobile payments have emerged as a game-changer for small businesses, revolutionizing the way we transact. With the increasing popularity of smartphones and the convenience they offer, mobile payments have become an integral part of our daily lives. This article will explore the impact on small businesses,...

Choosing the Right Payment Gateway for Your Business

In today's digital age, having a reliable and secure payment gateway is crucial for any business that operates online. A payment gateway is a technology that allows businesses to accept and process online payments from their customers. It acts as a bridge between the customer's payment information and the merchant's...

Understanding Credit Card Processing Fees: What Merchants Need to Know

In today's digital age, credit card processing has become an essential part of running a successful business. However, understanding the intricacies of credit card processing fees can be a daunting task for many merchants. In this comprehensive guide, we will delve into the world of credit card processing fees, providing...